Great Investments

Great investments with tremendous potential in a modernizing world.Saturday, December 23, 2006

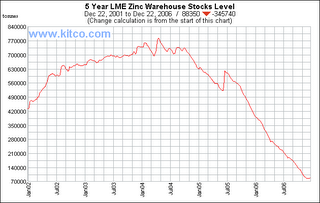

Why LME Zinc Inventory Depletion has Paused

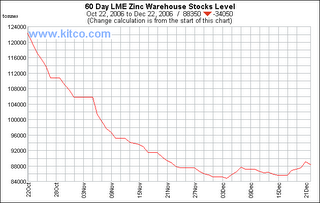

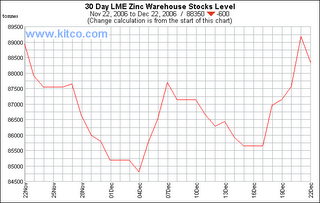

but it’s apparent on the 60-day and 30-day charts:

Why has the downtrend in LME zinc inventories paused in the 85,000-89,000 tonne range the last few weeks?

We believe 2 short-term factors have created a short-term surge in zinc supply which has caused the pause in the LME inventory downtrend.

- The world's biggest zinc mine, Teck Cominco's Red Dog in Alaska, had some delays in shipments in Q3, increasing their Q4 shipments significantly. Red Dog only can ship a few months out of the year because of their Alaskan climate, so the Q4 spike in zinc supply is much bigger than normal this year. Because of weather conditions, about 50,000 tonnes of zinc in concentrate that was expected to be shipped in Q3 2006 was delayed to Q4 2006 and Q1 2007, with 25,000 additional tonnes of sales in each quarter

- There was a surge in zinc exports from China ahead of a December 14 deadline for the ending of export tax rebates. With the extra 5% rebate disappearing, apparently Chinese smelters drew down any inventory they had and exported all they could by the December 14 deadline. The rebate didn't end for the special high-grade zinc (99.995%+ SHG zinc), "which is required by the LME for delivery against its zinc contract," so most of the surge was probably lower grade zinc. The surge in lower grade zinc probably meant some users had less need for SHG zinc, and thus there was likely a resultant short-term decrease in orders for SHG zinc, which is now being reflected in the buildup of inventories in the Singapore LME warehouse.

We believe that the Chinese rebate surge will be absorbed by the market fairly quickly as the Chinese smelters drop back their exports and build back their inventories. On the other hand, the effect of the Red Dog shipment spike will last into Q1. However, with the previous pace of LME Zinc depletion at around 80,000 tonnes per quarter, the additional 25,000 tonnes from Red Dog in Q1 shouldn’t prevent the downtrend in LME inventories from resuming, albeit at a temporarily decreased pace. We expect the zinc crisis to become very evident after the effects of the Red Dog shipment spike have dissipated by the end of Q1.

After the short term surge in supply from these 2 temporary events is absorbed by the market, we expect zinc to remain very strong because of the dearth of sizable projects in the pipeline for the next few years combined with growing demand and depletion of reserves at existing mines. We believe the fears in the market that the recent short-term trend change in zinc LME inventories could indicate a permanent shift in the supply/demand situation are misguided, and we expect that to become apparent in coming months. If the downtrend resumes as we expect, we believe the only way the LME Zinc inventories will avoid complete depletion is with zinc prices increasing enough to curtail demand.

Zinc inventories will decline?

The recent stock build has surely

rocked a thin market

<< Home

Archives

January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 May 2010

Great Investments Home Email GreatInvestments

Great Investment Articles Blog Great Trades BlogDisclaimer: Great Investments may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Investments contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Investments does not provide personalized investment advice.

Enter your email address in the box below to get emailed any new blog entries (within an hour or so of an update). Your email address won't be listed or sold.