Great Investments

Great investments with tremendous potential in a modernizing world.Friday, May 26, 2006

Reallocating from U.S. Stock Market to Undervalued Commodity Stocks

As evident from our recent postings, we have been been implementing this reallocation for several months already. We believe this stock market rally and the current correction in commodity stocks provide a great opportunity to complete this reallocation by decreasing exposure to the U.S. stock market and increasing exposure to select commodity stocks, particularly undervalued mining stocks. We don't know if the commodity stocks correction has ended already or will end a few months from now, but we're confident that the secular bull market in commodity stocks has a long way to go, and this correction is only a buying opportunity.

The above chart shows how, despite the recent sharp selloff in the overall stock market, gold and silver stocks have sold off even more sharply, bringing the ratio of the Gold & Silver stock index (XAU) to the S&P 500 (SPX) down significantly in the last 2 weeks. Junior mining stocks, which aren't included in the XAU, have sold off even more sharply than the major mining stocks represented by the XAU, creating what we believe is a significant long-term buying opportunity. You can see that, despite the sharp pullback in this ratio, the long-term trend remains intact. We believe, despite many skeptical analysts calling for a top on the "commodities bubble," the ratio will continue on this long-term uptrend for many years.

We are so confident that long-term investments in good commodity stocks will be extremely rewarding that we plan to cease active trading in the U.S. stock market. We expect a tougher market for traders in coming months/years, so we plan to take advantage of this bull market in commodity stocks and enjoy the ride with some select, undervalued stocks with events coming that should send their prices higher even if the underlying commodity prices head lower. The much lower long-term capital gains tax, the much lower stress level, and the much lighter required workload all tipped the scales in the decision to make this shift from active trading in an overvalued market to long-term investing in undervalued stocks.

We have set up this new Great Investments blog, where we've copied over the long-term investing posts for commodity stocks from here and will continue to post new long-term investing opportunities. We will continue to update Great Trades with the same posts, and may also continue to post shorter-term trades there occasionally. However, our focus and the bulk of our portfolio will be with the long-term investments in commodity stocks.

With sharp price increases in commodities in recent months/years, some may wonder if commodity stocks are in a bubble, and question whether there are any undervalued commodity stocks. However, while commodity prices have had huge price increases, most commodity stocks have lagged the underlying commodities significantly, pricing in far lower commodity prices. If commodity prices don't collapse as some people expect, these undervalued commodity stocks should do very well over the long term. If commodity prices go even higher over the long term, these stocks should be enormous winners with their leverage on the underlying commodities.

Unlike the tech boom, when you really had little idea which companies would become an ultimate growth success, we believe mining is much easier to evaluate, as once a deposit has been drilled, and grades defined, it can become a leading low cost project with very profitable returns, which we believe is the case for Metalline Mining, Avino, and Roxmark. Also unlike the tech boom, only a very small portion of the financial markets has invested in the resource and commodities sector.

While we believe investors in major commodity stocks will do very well, our focus is on junior mining stocks, as some of them provide much more upside given the inefficiency of the market for these stocks, the undervaluation and skepticism towards them given their lack of current income, and the consolidation in the industry that's already started to happen but will continue to increase significantly, in our opinion. Major mining companies have huge mines that are producing enormous cash flow today, but many of these mines will be closing in coming years, so they are running out of resources to develop for future income. With metals prices having increased significantly, they have extremely high levels of cash that they'll need to convert into future cash flow by investing in mining projects.

Finding and developing a resource can take 10-15 years or more, and many of the best resources in the world are in politically unstable areas of the world in the Middle East, Africa, South America, and Asia. As stated in our "Worldwide Zinc Crisis" post, "Other than Metalline Mining's mine in Mexico, the two biggest zinc mines scheduled to start production in the next 5 years are in Iran and Bolivia, two very unstable regions. If there's a war in Iran and if Bolivia nationalizes the mines in their country, the "zinc crisis" could become very dire." Major mining companies don't want to invest heavily in a project for 10 years only to have it seized by a militant government. Recent actions by the governments in Bolivia and Mongolia to potentially seize mines or mining income have raised the desirability of deposits in politically safe areas like North America.

Rather than investing heavily to try to develop productive mines on their own, many major mining companies are on the lookout for junior mining stocks with sizable metals deposits that they can buy out with their enormous cash piles. Junior mining stocks with large deposits that they can show can be economically extracted via a feasibility study will be in high demand. Because Metalline Mining's zinc deposit will likely be one of the top 5 or 10 producing zinc mines in the world, we'll be very surprised if they don't get several buyout offers upon completion of their ongoing feasibility study. However, shareholders of junior miners may be better off if these smaller companies can develop their deposits themselves, as the rewards when they get to production will be enormous, especially if metals prices continue higher in this secular bull market for commodities.

Our focus will be on junior mining stocks with deposits in North America and events coming up that should increase their stock prices even if commodity prices drop. For example, Roxmark Mines is applying for listing on the Toronto Venture exchange, giving it much more exposure than their current listing on the CNQ exchange, where many investors have difficulty buying it. They also will start producing revenue from their molybdenum in coming months and may restart activity on one of their 6 former-producing gold mines. Avino Silver & Gold will start producing revenue from the tailings at the Avino mine before getting the full mine into production in the next year or two. JER Envirotech, a non-mining commodity company, plans to open plants in Canada, Malaysia, the Philippines, China, and India in the next year or so as they focus on taking advantage of the industrialization of much of Asia. Metalline Mining is drill defining their high-grade silver/zinc/copper deposit that is separate from their ongoing feasibility study on the Iron Oxide manto, plus they will be applying for listing on a senior exchange in coming months.

As you can see, all of these companies have events coming up that should reward stockholders even if the underlying commodity prices drop. If commodity prices continue higher, they should be huge long-term winners. We will continue to look for these types of situations.

To help our readers understand why we are such strong advocates of investing for the long term in commodity stocks, we've created a repository of great investment articles at http://www.GreatInvestmentArticles.blogspot.com/. You can see there that some are calling this commodity stock correction "a buying opportunity of a lifetime" and "one of the best entry points into the junior market since the bottom in 2001-2002."

Tuesday, May 23, 2006

Worldwide Zinc Crisis, MMGG to Apply for Listing

"The world is out of zinc...

I’m not joking. All industrial metals are scarce right now, but none are as scarce as zinc. There simply isn’t any available.

I learned this yesterday on the golf course. Chris Hancock specializes in Asia. He is the author of a publication called the Asia Strategy Report. We were paired together in a corporate golf outing. While contemplating my approach shot to the sixteenth green, Chris started talking about zinc…

Kohler Inc. is a huge manufacturing conglomerate, best known for making bathroom fittings like sinks, latrines and faucets. They coat their products with zinc to stop corrosion.

“I was just in Hong Kong,” Chris told me, “and while I was there, I met up with a friend of mine who’s the manager of several Kohler plants in China. He told me they’re having trouble with zinc… they can’t find it anywhere.”

Chris continued: “At first I didn’t pay much attention. But then at dinner that night, I sat next to a guy from my MBA class. He’s an investment banker with UBS Warburg. He says all the traders at Warburg are buying zinc like crazy and that the zinc price is about to run. But get this...

On the plane back from Shanghai, we start chatting to the lady in the seat next to us. It turns out she manages a plant in Chicago for one of the large office supply retailers. She said she’d been in China visiting factories. We told her we had been doing the same thing. We asked her how her trip went - if she’d had any problems sourcing materials for her plant – and she told us she did. She couldn’t get hold of any zinc!”"

Crisis to get Worse; Metalline Mining in the right place at the right time

With their drill-proven 5 billion pounds of zinc, Metalline Mining (MMGG) has one of the very few huge zinc mines in the world ready to go into production in the next few years. The article shows why they're in the right place at the right time to be an enormous winning long-term investment.

Keep in mind, there are also a number of large zinc mines that will be closing in coming years, with few mines coming online (even fewer if Yukon Zinc's Wolverine project doesn't get financed), making the "zinc crisis" even worse. Other than Metalline Mining's mine in Mexico, the two biggest zinc mines scheduled to start production in the next 5 years are in Iran and Bolivia, two very unstable regions. If there's a war in Iran and if Bolivia nationalizes the mines in their country, the "zinc crisis" could become very dire.

Given that there's already a crisis, and even with these mines there wouldn't be enough zinc produced to match even current production, it looks like the crisis will get much worse. China and India's growth will require a lot more zinc, which is not easily replaceable like some of copper can be. For most applications (e.g., galvanized steel), zinc is only a tiny portion of product costs, so there shouldn't be high price sensitivity to curtail demand.

In addition to their zinc, Metalline Mining's recent stellar silver drilling results means you get a high-grade silver stock thrown in "for free," as the stock is actually down over 17% from where it closed before announcing the silver drilling results, having been caught up in the recent selloff in mining stocks.

Metalline Mining to apply for listing on a "senior exchange"

Metalline Mining recently confirmed their intent to file a listing application with a senior exchange, hidden in their Schedule 14A about the annual meeting July 7, page 21:

"For example, the Company intends to file a listing application with a senior stock exchange. Any senior stock exchange listing would require the Company to have at least 50% of its board comprising of independent directors. Moreover, a senior exchange listing would require adding directors with financial expertise."

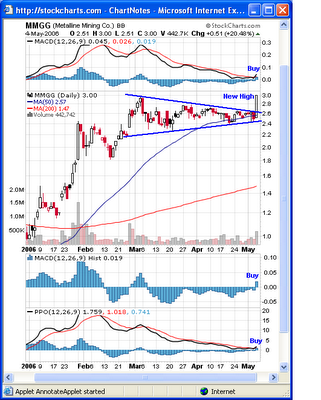

Once they get off the bulletin board, they can attract much more investor interest, particularly from institutional investors who won't touch a bulletin board stock. We think when they formally announce their listing application, the stock will rally. After the recent pullback to retest the breakout area around the multi-year high, MMGG's chart is set up very nicely for such a rally...

The future looks very bright for Metalline Mining...

Monday, May 22, 2006

Has the "Commodities Bubble" popped?

We at Great Investments agree with PIMCO, who says there is no bubble in commodities. Our thinking is more in line with those analysts saying the current selloff in mining stocks means we're "heading towards a buying opportunity of a lifetime here" and a "speculative frenzy" is coming for junior mining stocks in the second half of 2006 and especially 2007. Also, investment guru Jim Rogers will no sell any commodity, despite the fall.

We believe, as renowned analyst Marc Faber explains:

"in real terms, commodities are still relatively low compared to equities and therefore, also given the length of the cycle - the cycle for commodities lasts usually 45 to 60 years peak to peak or trough to trough - in other words the upward wave in commodities lasts around 22 to 30 years and we are now in year 2006. The bull market started in 2001 so we are five years into the bull market. I do concede that the markets are overbought and there is a lot of speculation and I expect a correction but I think longer term from here onwards commodities will outperform the Dow Jones and financial assets."

While the current correction in commodities could last a few more months, we believe some commodity stocks have already bottomed and most will bottom before the underlying commodities because they already discount much lower commodity prices. We view this correction as a tremendous buying opportunity in select commodity stocks for the long term.

Thursday, May 11, 2006

Metalline Mining (MMGG), the Silver Stock

We've been pounding the table on MMGG for months based on their zinc mining potential, but now they deserve a much higher valuation based on their huge silver potential in addition to the zinc.

Despite the recent sharp rally in the stock that has already met the cup & handle breakout target over $5 we mentioned last Friday, MMGG remains our favorite stock and best idea for long-term upside potential.

Friday, May 05, 2006

MMGG Cup & Handle Breakout

After yesterday's breakout from a bullish triangle formation to a new yearly high on good volume, the daily chart is flashing buy signals on various indicators:

The weekly chart looks like it's going through a Cup & Handle breakout (http://www.stockcharts.com/education/ChartAnalysis/cupHandle.html):

With the depth of the cup at about $2.17, the Cup & Handle breakout target is over $5. That would be well above the 2004 high of $3.35 and the 2000 high of $4.35.

Given the change in fundamentals since 2004 and 2000, it makes sense that MMGG's stock price should be much higher now. The price of zinc has more than tripled since 2004, with the over $1.00 increase in the per pound price amazingly representing over $5 billion in future profits to MMGG if the price of zinc remains strong. As long as the price of zinc doesn't collapse below the 2004 price, the numbers for MMGG based solely on their zinc are staggering.

Silver and copper have likewise approximately tripled, so if Metalline can show economic grades of these metals, the upside is hard to imagine. Given the indication in the recent President's letter to shareholders that work on the silver/copper side has restarted, we should know fairly soon whether MMGG should be considered more than just a zinc stock:

"Work on the copper silver mineral system has been reactivated. The copper silver mineral system produced high grade direct shipping ore from 1906 until about 1995 from about 45 mines over an area of approximately 5 kilometers east-west by 1 kilometer north-south. The dump material from all of these mines has mill grade copper silver mineralization. There is underground access through these mines continuously for 5 kilometers east-west. Metalline explored the north side copper silver mineralization from 1996 to 1999 and has collected over five thousand channel samples from these workings that have economic grades, particularly at present metal prices. We are drilling and channel sampling this mineralization in the area known as the Polymetallic Manto that runs for a distance of about 1500 meters from the San Salvador mine to the Fronteriza mine parallel to the Iron Oxide Manto to the north. We are evaluating the data that has been collected and analyzed and will announce the results as this work progresses."

Looking at the fundamentals and the technicals, it seems Metalline Mining is destined for much higher prices over the long term.

Thursday, May 04, 2006

MMGG Valuation Analysis Update

Since our original valuation analysis in January, some things have changed at MMGG. Zinc has climbed from .9366/pound to $1.57/pound. UBS Securities, which is notoriously conservative in their metal price projections, has upped its target for the average per pound zinc price to $1.654 for 2006 and $1.85 for 2007, up 95% on the previous outlook. Look for them to up their targets yet again within a year. MMGG also has completed a private placement to raise the funds necessary to complete the feasibility study, which also increased the number of shares outstanding.

Using today's price of $1.57/pound (being more conservative than the UBS targets), we've updated the calculations we did in January on MMGG's zinc deposit, again using ballpark estimates, with the results of the 3 different valuation methods show below:

1. Skorpion mine value -- The Skorpion mine buyout in 1999 valued Skorpion at about $150 million. MMGG's zinc deposit is very similar in size to Skorpion's, and likely has a lower capital cost. With the price of zinc now about triple the 1999 price, and with gross profitability for a 25 cent zinc producer being over 6 times that of 1999, one could guess at a buyout price of about 6 times the Skorpion buyout price. If the zinc shortage continues to worsen and the zinc price continues higher, MMGG's zinc becomes more valuable. Given approximately 49 million fully diluted shares outstanding after the recent financing, such a buyout would be equivalent to about $18-20/share.

2. Multiple of annual earnings -- While it won't be known until the feasibility study is complete, the cost of going into production (building the mine and extraction plant) has been estimated at between $250 and $400 million (Skorpion was over $450 million). Assuming $400 milliion is needed, and is financed with 60% bank debt financing (standard with a bankable feasibility study) and 40% equity financing, 40-50 million shares of dilution would be required at a stock price of $3.20-$4/share (a 50% joint venture for someone to provide only 40% of the cost to go to production would be even better for shareholders). Assuming an 11-year life of the plant, 180 million metric tons/year processed, a 25 cents/pound cost to produce zinc, and the current 1.57 price of zinc, annual revenues would be over $620 million, gross profit over $520 million, and annual earnings (before taxes) of nearly $500 million. A 4x multiple would result in a stock price over $19 while a 5x multiple would result in a stock price over $26. Discounting the 4x multiple back 15%/year for 3 years to production would result in approximately a $13 stock price, while discounting the 5x multiple back 10%/year for 3 years would result in approximately an $20 stock. This method results in approximately a $13-20/share estimated value.

3. Present value of earnings stream -- MMGG's management is negotiating with Mexico (for the mine) and other countries (for the extraction plant) for tax breaks. The present value of an earnings stream of 80% (to net out taxes) of the earnings calculated in #2 above over 11 years using a 15% discount rate is over $2 billion, or over $22.50/share. Using a 10% discount rate results in nearly $28/share. Discounting further by 15%/year and 10%/year, respectively, over 3 years to get to production results in approximately a $15-21/share estimated value.

All 3 of the above methods result in a share price after the feasibility study of about $13-21 based solely on the zinc deposit. If the silver/copper side turn out to be more valuable than the zinc side, MMGG could be worth more than $40/share, especially if the prices of zinc, silver, and copper continue higher.

Lots of assumptions are built into the above calculations, so take them with a grain of salt. However, many of the uncertainties will be removed during the completion of the feasibility study over the next year or so, and the numbers will become clearer to all. Some may be better than assumed and some may be worse. However they turn out, it looks like MMGG at the current price level is extremely undervalued and poised to move much higher.

Archives

January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 May 2010

Great Investments Home Email GreatInvestments

Great Investment Articles Blog Great Trades BlogDisclaimer: Great Investments may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Investments contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Investments does not provide personalized investment advice.

Enter your email address in the box below to get emailed any new blog entries (within an hour or so of an update). Your email address won't be listed or sold.