Great Investments

Great investments with tremendous potential in a modernizing world.Monday, November 27, 2006

MMG Cup & Handle Breakout II

That pattern played out perfectly, as the stock proceeded to trade over $5 both in May and in June.

Today, MMG is rallying on drill results indicating a potential new zinc deposit, and the stock is again displaying the same cup & handle chart pattern. In fact, if you look at the chart we showed you in the spring (weekly) next to the current chart (daily), you can see these charts are eerily similar, even down to the volume patterns:

In both cases, the stock was driven down on low volume by impatient sellers, and then exploded back higher on much higher volume when that selling pressure was gone and the fundamentals took over, recovering the previous losses. A handle formed each time as the stock consolidated the big recovery in a relatively tight trading range, as profit takers exited and new investors entered. A breakout from this handle consolidation is very bullish and points to higher prices to come.

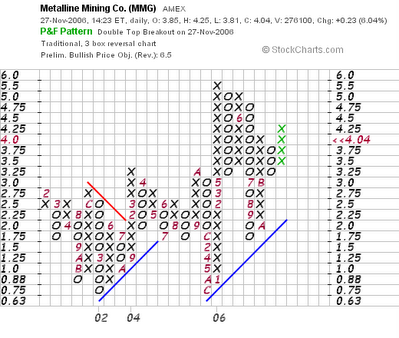

With the depth of the current cup about $2.58, the Cup & Handle breakout target is over $6.50, about a dollar higher than the spring high. Interestingly, the P&F chart also points to a preliminary target of $6.50:

We’ve shown how the fundamentals point to a much higher stock price for MMG over the long term. Now, the technical analysis points to a much higher price, too. We don’t know if the current Cup & Handle pattern will play out as well as the last one, but we remain very confident in the long-term upside of the stock.

Tuesday, November 14, 2006

Acadian Gold -- Hidden Zinc Opportunity

About a year ago, with zinc trading at about .70/pound, Acadian worked out a deal with HudBay Minerals to purchase 100% of the previously producing ScoZinc from them for CAN$7.5 million, signing the letter of intent in December 2005 and closing the deal in July 2006. ScoZinc’s principal assets are a modern mill and zinc/lead deposits (the Scotia mine) 50km north of Halifax. With the price of zinc nearly tripling since they convinced HudBay to sell them ScoZinc, Acadian really hit it big with this purchase.

Acadian has already completed a positive feasibility study for the Scotia Zinc mine. With much of the infrastructure already put in place by a prior operator, the project is basically a turn-key project with minimal start-up requirements, allowing the mine to be put into production in Q2 2007. The Scotia Zinc mine is expected to produce 39.8 million pounds of zinc annually at a $0.36 cash cost per pound. With zinc over $2, the pre-tax cash flow should be nearly the same as Acadian’s current market cap, which is approximately $60 million U.S. fully diluted. If zinc moves much higher in the next 6 months, which seems likely given the LME zinc inventories are on pace to be gone within 3 months, the Scotia Zinc mine could produce more cash flow than Acadian’s entire market cap.

Acadian’s plan is to use the high cash flow from the Scotia Zinc mine to fund development of the Scotia Goldfields project, which has 4 properties progressing to the pre-feasibility stage to determine their economic viability. This approach of using near-term cash flow from base metals to fund development of their gold properties is similar to that of Roxmark Mines, one of our long-term favorites that we highlighted in April, and helps to balance the risk of base metals with the gold potential. Acadian also plans to issue a dividend to shareholders after zinc production starts, which is unheard of for a junior miner.

Acadian Gold has only a tiny fraction of the zinc of our favorite miner, Metalline Mining, but their near-term cash flow relative to its tiny market cap along with their gold properties make it a very attractive investment for those looking for a near-term zinc producer with good gold potential.

Technically, ADA tested its all-time high last week after recent MACD and money flow buy signals shown in the below weekly chart:

We believe investors who accumulate ADA under the .75 resistance area will be well rewarded in coming months when the stock breaks out from its base and heads much higher where it belongs. The market hasn’t yet recognized the zinc potential of this gold stock, but we believe this hidden zinc upside, which alone is arguably worth much more than the current stock price, won’t remain hidden for long.

Friday, November 03, 2006

How High Can MMG Go?

Here's an article on calculating the value of a mining stock: http://personalfinance.iii.co.uk/articles/articledisplay.jsp?article_id=2278403

Julian Baring, the well known City ‘gold bug’, used to value mining stocks

by taking, as a rough guide, 10% of the value as calculated in the previous

paragraph as being the correct value for the company in question.

Gold mining rule of thumb

Curiously enough, this rough and ready guide seems to hold good today.

Figures calculated by the Mining Business Digest in 2000, based on data for

corporate acquisitions in the gold sector, reckoned that those at the earliest

stages of exploration, with some inferred resources, would be valued at most at

around 3.5% of the underlying metal value in the ground. An average for those

with more tangible metal assets to develop would fetch around 11% of underlying

value while those in the early stages of production could see a value of

anything from 15% to 25% of the value of the underlying ounces of metal in the

ground. It is not a hard and fast rule, however, and those mining base metals

are valued at correspondingly lower rates.

There is some more data confirming this gold mining rule of thumb.

According to figures compiled by Galahad Gold and sourced from broker reports

and the publication Gold Stock Analyst, the average value placed on ‘ounces in

the ground’ in 2005 was $120 for second tier companies about to start

production, $50 an ounce for those with resources that had been measured and/or

indicated, and $32 an ounce for those with simply inferred resources. This

compares with an average gold price for 2005 of $444, making the respective

percentages 27%, 11.2%, and 7.2% – not too far from those quoted earlier.

If you take MMG's 5.8 billion pounds of proven zinc and don't count anything for their high-grade silver and separate zinc for which the resource hasn't been estimated yet (the SEC doesn’t allow U.S. companies to disclose inferred resources), you can see how MMG is worth many times its current price:

Zinc today is at $1.9482/lb.

5.8 billion x $1.9482/lb. = $11,299,560,000 of proven zinc resources

$11,299,560,000 / 49.7 million shares fully diluted = $227.36 worth of zinc per share

10% of $227.36 is $22.74 per share value per Baring’s rough guide.

MMG’s zinc is a base metal, so some would say the value should be lower than for gold miners, but with its zinc project at a very late stage compared to most preproduction miners, and profit margins likely much higher than most gold miners (let’s say conservatively .35/lb. production costs, what Skorpion sold zinc for in 2003, for $1.9482/lb. refined zinc -- equivalent to $112.68 production costs for $627.20/oz gold, which would be very high margins for a gold miner), MMG should arguably get a higher value than gold miners.

To give you an idea of the upside once MMG gets to production, here are the numbers for HudBay:

HudBay Minerals:

3.11 billion lbs. x $1.9482/lb. = $6,058,902,000 of proven zinc resources

$6,058,902,000 / 124,796,513 basic shares outstanding = $48.55 worth of zinc per share

HBM closed at 19.28 CAD today, or about $17.16 USD per share

$17.16 / $48.55 = 35.35% of the value of their proven zinc

Baring used to say about valuing mining shares, “"Buy up to 10% of the in situ value of a deposit using current metal prices, hold up to 40% and sell above 40% taking no prisoners!!!!". Since HudBay is in production, and has other metal byproducts to help give them very high profit margins, we believe it is still undervalued, even as it approaches the 40% level for its proven zinc, as we expect zinc to move higher and HudBay’s profitability to go even higher.

Here’s the final weekly chart of MMGG before the rebirth as MMG (click on chart for larger view). You can see that in addition to the severe undervaluation pointing to higher prices, the chart is turning around and pointing higher as well.

Notably, all the big volume weeks have been up weeks, while the down weeks have been on lower volume. MACD is just hitting a buy signal. As in 2005, there was an extended period of several months in 2006 with negative money flow (the CMF chart at the bottom) and a sharp sell-off on lower volume. The 2005 sell-off ended with a sharp rally from under $1.00 to $5.67 with positive money flow all the way. With money flow just starting to turn positive and new investment from institutions expected on the new exchange, we’ll be interested to see how far this rally takes the stock in coming months/years.

While there may be some short-term pullbacks along the way, with zinc breaking out to new all-time highs and the company’s zinc feasibility study moving toward completion, it looks like the stock is poised to break out of its trading range and begin a new trend higher in coming months.

Thursday, November 02, 2006

Mmm, Mmm, Good

After months of no action and impatient investors bailing out on low volume, Metalline Mining announced this morning that their application for American Stock Exchange listing has been approved, and they will begin trading on the Amex on Monday.

With zinc breaking out to a new all-time high, LME zinc inventories quickly getting devoured, and management on an international road show with institutional investors, the Amex listing is coming at a perfect time.

Many investors, particularly institutions, won’t buy a stock that’s on the OTC bulletin board, which has a reputation for being a “penny stock” haven with lots of scams. The Amex listing will give Metalline credibility and will put it on the list of many institutions around the world.

As arguably the best metal for investors today (http://greatinvestments.blogspot.com/2006/10/forget-all-other-metals-think-zinc.html), zinc is attracting a lot of investment interest. The above chart of LME Zinc Warehouse stocks shows that the zinc crisis is headed for an explosive event within a few months as the zinc inventory is quickly headed for 0. Of course, the inventory can’t go below 0, so something is going to have to change to keep the inventory positive. Despite the near tripling of the price of zinc over the past year to near $2/lb., the demand for zinc has not slowed down the rapid pace of inventory depletion. The price of zinc would need to nearly triple again to make a new all-time high in real, inflation-adjusted terms. Basic supply and demand economics indicate zinc is headed for an explosive move higher. In the coming zinc crisis, the price of zinc will need to rise high enough to curtail demand significantly.

This article from earlier this year gives a great overview of the zinc market, with great charts as well as text:

http://greatinvestmentarticles.blogspot.com/2006/07/case-for-zinc.html

Because GTI produced a positive feasibility study and got the similar Skorpion mine into production when zinc was at 35 cents, we believe that GTI will produce a very positive feasibility study for Metalline Mining now that zinc is over 5 times higher. With 5.8 billion proven pounds of zinc and a fully diluted market cap around $150 million, we continue to believe Metalline Mining is extremely undervalued for one of the world’s largest zinc projects at such a late stage of development, at about 1% of the value of their proven zinc.

For a quick valuation comparison, let’s compare Metalline to one of the few zinc producers, HudBay Minerals (HBM on the Toronto Stock Exchange).

HudBay:

Zinc reserves = 21,400,000 tonnes of 5.3% zinc (1,134,200,000 tonnes contained zinc),

less about 85 million tons reserves mined in this year’s production so far,

leaving approx. 1,050,000 tonnes contained zinc reserves remaining

Resources = 4,900,000 tonnes of 7.4% zinc (362,600 tonnes)

Total = 1,412,600 tonnes contained zinc, or 3.11 billion lbs.

(from http://www.hudbayminerals.com/oreReserves.php ) on 1/1/06

124,796,513 shares outstanding (unclear what fully diluted is) x 19.07 CAD = $2,379,869,503 CAD x .89 = $2,118,083,858 USD basic market cap

(from http://www.hudbayminerals.com/investorRelations.php )

$2,118,083,858 / 3.11 billion lbs. = $.681 per proven pound of zinc

(HudBay also mines some other metals as byproducts, which they apply as credits to decrease their cost of zinc mined)

Metalline:

Iron Oxide Manto = 28,042,538 tonnes of 7.04% zinc (1,974,185 tonnes contained zinc)

(from page 29: http://www.metalin.com/Metalline,%20Sierra%20Mojada,%20Zinc%20060625.pdf )

Smithsonite Manto = 5,431,050 tonnes of 12.08% zinc (656,070.84 tonnes)

(bottom of page 1: http://www.metalin.com/03-18-05.pdf )

Total = 2,630,255.84 tonnes contained zinc, or 5.8 billion lbs.

49.7 million shares fully diluted x $3.10 = $154,070,000 fully diluted market cap

(there are only 34,126,661 basic shares outstanding per

the last 10Q filing , but we’ll use fully diluted to be conservative)

$154,070,000 / 5.8 billion lbs. = $.0266 per proven pound of zinc

As a zinc producer, HudBay deserves a higher valuation than Metalline’s preproduction zinc project, but assuming Metalline can get to production, this comparison shows that the upside is enormous, even after the recent recovery of the stock from the artificially low prices caused by the one big seller we mentioned in August. Even though zinc is much higher now, the Amex listing has been approved, and its project has advanced significantly, Metalline’s stock remains well below its May high of $5.67. If they don’t get bought out, they’ll likely need to dilute the existing shares significantly during financing for the move to production, but even after discounting heavily for that dilution and the multi-year wait for production cash flows, Metalline has at least 10-fold upside, especially considering the zinc crisis and the high-grade silver they’re drilling.

Some investors have told us they’re worried that the cost of piping water in a long distance (an early October press release indicated Metalline has located water 20 km away from the project site) may make the project unfeasible. However, Skorpion was proven feasible at 35 cent zinc even though they have to pipe water in from 45 km away (http://www.gti.co.za/Skorpion.htm). Also, Metalline could locate the refinery elsewhere, near water, if the nearby water isn’t sufficient. Their earlier testing showed that they can easily produce a concentrate from the ore which they can ship anywhere in the world for refining, meaning they can locate the refinery wherever it makes the most sense from a tax incentive, power, labor, etc. standpoint. This flexibility gives them negotiating power with Mexico and other countries to get the best all-around deal for the refinery.

As we explained in August, we believe several companies will try to buy Metalline’s zinc project after completion of the feasibility study. With the largest proven preproduction zinc project in the world that major mining companies will be able to buy, in a politically safe part of the world, Metalline Mining will be sitting in the driver’s seat when the cash-rich suitors with dwindling reserves come calling.

After suffering through the junior mining sector carnage and being held hostage by one big seller on low volume the past few months, we’re very pleased that Metalline Mining is finally graduating to the big leagues from the pee wee arena. Metalline Mining's typical shareholder profile will be changing drastically from bulletin board traders to high profile international institutions.

To us, the Amex listing under the new MMG symbol is Mmm, Mmm, Good.

Archives

January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 May 2010

Great Investments Home Email GreatInvestments

Great Investment Articles Blog Great Trades BlogDisclaimer: Great Investments may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Investments contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Investments does not provide personalized investment advice.

Enter your email address in the box below to get emailed any new blog entries (within an hour or so of an update). Your email address won't be listed or sold.