Great Investments

Great investments with tremendous potential in a modernizing world.Sunday, July 30, 2006

3rd Technical Analysis Buy Alert on MMGG

As we expected, the short-term market rally in late May/early June proved to be a great opportunity to “significantly reduce or eliminate exposure to the overall U.S. stock market.” While the commodity stock indices, comprised of large-cap commodity stocks, have rallied back vs. the overall stock market, many junior mining stocks have remained in the doldrums. For those who haven’t yet redeployed capital into undervalued commodity stocks, we believe the recent weakness in these stocks represents a great long-term buying opportunity.

As many of our readers know, Metalline Mining (MMGG) has been and continues to be our favorite stock and best idea for long-term upside potential. We have shown MMGG’s chart and highlighted particularly good buying opportunities based on technical analysis buy signals 2 different times so far this year, first at the beginning of the year in our original, most detailed report and then in early May on the breakout from consolidation. Both times MMGG proceeded to rally sharply (tripling in 2 months at the beginning of the year, and then doubling in 6 days in May, moving above the stated $5 target from the cup and handle buy signal), as you can see in the below chart:

In this update, we are highlighting our 3rd particularly good buying opportunity on Metalline Mining based on technical analysis. As you can see at the bottom of the chart, our 2 previous TA buy alerts coincided with MACD buy signals triggered by MACD crossing above its trigger line from a low level. After the sector correction of the last few months caused impatient investors and momentum investors to sell out, pushing the stock down below 3 to retest the previous consolidation area and the 200 day exponential moving average, a 3rd MACD buy signal has just been triggered with MACD at a more oversold level than the first 2 times. The selloff also filled the gap at $3.00 that was left from the early May rally. Closing above $3.00 on Friday is another bullish signal.

Fundamentals Better than Ever

In addition to the technical analysis looking great here, the fundamentals for Metalline are better than ever, as detailed in previous updates.

In the next few months, the following events should help MMGG move higher:

1. Listing on the American Stock Exchange. Lots of investors, especially funds and institutions, won't buy a bulletin board stock, so have been waiting for Metalline to get listed (likely under a new symbol/name on Amex) to buy. While the company has still not formally announced its application for listing, it did disclose their intent to file the application back in May.

2. New drilling results to reinforce results released the last few months indicating very high-grade silver and another high-grade zinc deposit in addition to the 5 billion pounds of drill-proven zinc.

3. Mine plan completion. This key part of the feasibility study on their proven zinc deposit will show most of the costs involved in mining the zinc. It also may allow the company to remove the silly cautionary note at the end of every press release stating they have no known reserves, which has been scaring investors away.

4. Resolution of the Mexican presidential election. By law, a winner must be declared by September 6. Clarification of this mess should provide a big lift to Metalline, especially if Calderon, the pro-free trade, pro-jobs, pro-U.S. candidate who won the first count, prevails. Mexico would then be seen as a politically stable country friendly to U.S. business and would be very accommodative to a big new employer setting up a big mine and employing lots of Mexicans. The current uncertainty that has affected MMGG and other Mexican mining stocks will be gone once there’s a clear outcome.

5. Road show to Europe. After the stock gets listed, management will meet with European institutions on a road show which should bring in a whole new group of shareholders.

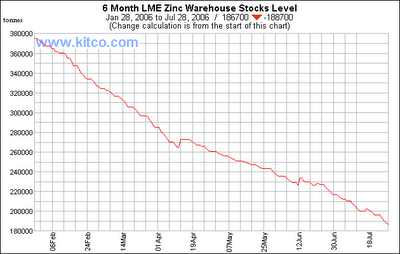

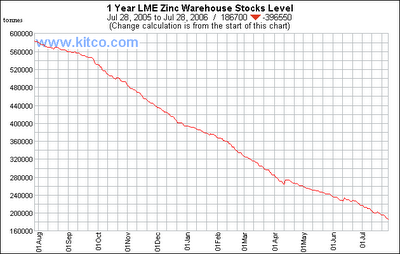

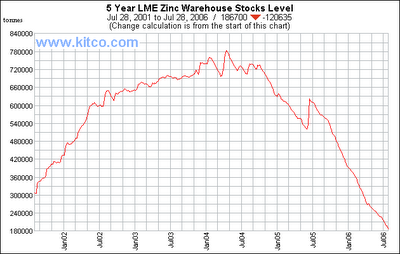

6. Depletion of usable zinc inventories. A large part of the current 186,700 tonnes of LME zinc stocks is in New Orleans and unavailable for use because of contamination after hurricane Katrina. As the usable stocks get used up, it will be interesting to see what happens to the price of zinc if they can't make the New Orleans inventory available. At the recent pace of depletion (over 30,000 tonnes per month over the last year), that could happen within the next few months. Even if all of the New Orleans inventory becomes usable, the current stocks will last less than 6 months if the trend in the below charts continues.

Even the tripling of the price of zinc over the last year hasn’t slowed down the depletion of zinc inventories. What will the price of zinc have to do to slow down this depletion? Zinc inventories can’t go below zero, so something’s going to have to change soon. If the price of zinc moves up significantly because of the zinc crisis, Metalline’s zinc will be worth much more.

Longer term, we believe Metalline can not stay this cheap if the ongoing feasibility study is successful. They have over 100 pounds of proven zinc per share (5 billion pounds using a very conservative 5% cutoff grade, much more using a lower cutoff, and less than 50 million o/s fully diluted), so with zinc around $1.50 and MMGG around 3, the company is valued at 1/50th, or 2% of the proven metal value. Such a low valuation is ridiculous for a miner in a stable area with potentially one of the biggest zinc mines in the world well into the feasibility study. If they move to 10% of the proven metal value, it would move up 5 times the current price (more if they use a lower cutoff, prove out more zinc, or zinc moves higher). In addition, they have very high-grade silver which could also make them a huge silver miner, and they also have extremely high-grade zinc in another potentially huge zinc deposit.

When we look at the technicals combined with the fundamentals and the events expected in coming months, we can’t help but conclude that MMGG is a compelling buy for the long term at the current level and on any dips.

Archives

January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 May 2010

Great Investments Home Email GreatInvestments

Great Investment Articles Blog Great Trades BlogDisclaimer: Great Investments may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Investments contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Investments does not provide personalized investment advice.

Enter your email address in the box below to get emailed any new blog entries (within an hour or so of an update). Your email address won't be listed or sold.