Great Investments

Great investments with tremendous potential in a modernizing world.Saturday, December 23, 2006

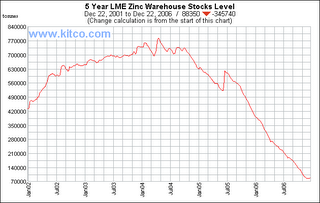

Why LME Zinc Inventory Depletion has Paused

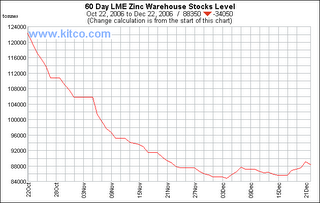

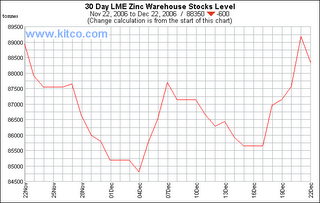

but it’s apparent on the 60-day and 30-day charts:

Why has the downtrend in LME zinc inventories paused in the 85,000-89,000 tonne range the last few weeks?

We believe 2 short-term factors have created a short-term surge in zinc supply which has caused the pause in the LME inventory downtrend.

- The world's biggest zinc mine, Teck Cominco's Red Dog in Alaska, had some delays in shipments in Q3, increasing their Q4 shipments significantly. Red Dog only can ship a few months out of the year because of their Alaskan climate, so the Q4 spike in zinc supply is much bigger than normal this year. Because of weather conditions, about 50,000 tonnes of zinc in concentrate that was expected to be shipped in Q3 2006 was delayed to Q4 2006 and Q1 2007, with 25,000 additional tonnes of sales in each quarter

- There was a surge in zinc exports from China ahead of a December 14 deadline for the ending of export tax rebates. With the extra 5% rebate disappearing, apparently Chinese smelters drew down any inventory they had and exported all they could by the December 14 deadline. The rebate didn't end for the special high-grade zinc (99.995%+ SHG zinc), "which is required by the LME for delivery against its zinc contract," so most of the surge was probably lower grade zinc. The surge in lower grade zinc probably meant some users had less need for SHG zinc, and thus there was likely a resultant short-term decrease in orders for SHG zinc, which is now being reflected in the buildup of inventories in the Singapore LME warehouse.

We believe that the Chinese rebate surge will be absorbed by the market fairly quickly as the Chinese smelters drop back their exports and build back their inventories. On the other hand, the effect of the Red Dog shipment spike will last into Q1. However, with the previous pace of LME Zinc depletion at around 80,000 tonnes per quarter, the additional 25,000 tonnes from Red Dog in Q1 shouldn’t prevent the downtrend in LME inventories from resuming, albeit at a temporarily decreased pace. We expect the zinc crisis to become very evident after the effects of the Red Dog shipment spike have dissipated by the end of Q1.

After the short term surge in supply from these 2 temporary events is absorbed by the market, we expect zinc to remain very strong because of the dearth of sizable projects in the pipeline for the next few years combined with growing demand and depletion of reserves at existing mines. We believe the fears in the market that the recent short-term trend change in zinc LME inventories could indicate a permanent shift in the supply/demand situation are misguided, and we expect that to become apparent in coming months. If the downtrend resumes as we expect, we believe the only way the LME Zinc inventories will avoid complete depletion is with zinc prices increasing enough to curtail demand.

Wednesday, December 20, 2006

Roxmark Mines Update

We believe Roxmark will receive the Toronto exchange listing approval in the near future (an October investor presentation had the end of 2006 as a goal for listing), and that listing will bring in new investors who haven't been able to buy the stock on the CNQ exchange. For those able to buy RMKL on the CNQ exchange or RMKMF on the U.S. pink sheets, we believe the current price, still around .21, provides a great entry into this small-cap near-term molybdenum and gold producer. The current market cap is around the same value or less than the value of their modern mill, which can process both molybdenum and gold.

As we said in the spring, "We believe Roxmark shares are likely to go much higher over the long run if things go as planned. We like the molybdenum giving them near-term revenue, the Toronto listing giving them more investors in coming months, and the huge upside with the gold properties." See the spring article for more details: http://greatinvestments.blogspot.com/2006/04/roxmark-mines-for-long-term.html

Tuesday, December 12, 2006

What Will Zinifex Do With All Of Its Cash?

Zinifex, one of the largest zinc mining companies in the world, plans to "sell out completely as soon as practicable, thus severing all links with its smelter activities." Zinifex will focus on their higher margin mining business, which we believe means they will be looking to replace their depleting zinc reserves via takeover: "With the cash from the smelter sales and an ungeared balance sheet, Zinifex certainly would have the capacity to undertake large-scale takeovers if it wished, both locally or overseas." Zinifex only has less than 5 years of mine life left at Rosebery and less than 10 years left at the huge Century mine, with its smaller Dugald River project only going through prefeasibility studies at this point. If they can't extend the mine life at the Century mine, they'll need to replace that production with other large zinc projects soon.

If Zinifex decides to buy a world class preproduction zinc project that has already completed a feasibility study to prove economic viability, it won't have much to choose from, as we explained in our last article: "If MMG can successfully complete the feasibility study for their Sierra Mojada project at anywhere near expected production rates, the problems at Mehdiabad and San Cristobal could make Sierra Mojada the only world-class sized zinc project in the world proven feasible and scheduled for production in the next few years. At a time of zinc crisis, where MMG is also the only zinc junior miner listed on a major exchange in the U.S., MMG’s 100% owned Sierra Mojada project could become the premier mining takeover target."

Since that article, the situation with Mehdiabad in Iran has worsened, as the Iranian government has decided to cancel agreements with its Australian partner who was managing the project.

Metalline Mining could be completing their feasibility study on their zinc project around the same time Zinifex sells out from their smelter operations, raising a significant amount of cash. It could be a perfect match for a Zinifex buyout. However, as we explained in January, we believe Anglo American will try to buy Metalline's zinc deposit, and in an August article we explained that there are a number of other major mining companies in a similar situation to Zinifex, filling up their coffers "with incredible sums of cash while their reserves and resources decline. Rather than investing heavily in exploration, decreasing reported profits and making them look less attractive to the financial community, large mining companies are buying other companies with large mineral deposits."

As we expressed last time, "We expect multiple takeover bids at much higher levels from cash rich major mining companies looking to replace their depleting reserves. While we believe shareholders would best be served by MMG going to production alone, takeover bids would ensure MMG a more appropriate market valuation for their premier assets." MMG currently trades at a small fraction of expected annual cash flow from their zinc project, but we don't think that will remain the case for long.

Monday, December 04, 2006

And Then There Were None?

- Mehdiabad in Iran has had difficulties financing the $1.6 billion project because of Iranian political issues, so in order to try to secure financing, management has decided to conduct a scoping study to consider a number of lower cost options to stage the project and start with much lower production. They’ve also had issues with the Iranian government http://www.unioncapital.com.au/UCL/documents/feedback.html. The U.S. recently ordering banks to shut down operations in Iran won't make financing any easier. It looks like if Mehdiabad can get financing and make it into production in the next few years, it will be on a much smaller scale than originally planned.

- Apex Silver's San Cristobal in Bolivia, which has presold a huge portion of their zinc production at .48/lb, is still scheduled to start production in late 2007. However, on Sunday, President Evo Morales completed the nationalization of Bolivia’s Natural Gas industry, signing contracts to take control over foreign companies’ operations: http://biz.yahoo.com/ap/061203/bolivia_nationalization.html?.v=3. As that article explains, “Morales has said he plans to nationalize Bolivia’s mining sector.” After nationalizing Bolivia’s petroleum industry in May, some thought his threat to nationalize mining had no teeth, but the nationalization of the Natural Gas industry shows Morales means business. If Morales succeeds in nationalizing mining, that could delay or reduce production from San Cristobol.

If MMG can successfully complete the feasibility study for their Sierra Mojada project at anywhere near expected production rates, the problems at Mehdiabad and San Cristobal could make Sierra Mojada the only world-class sized zinc project in the world proven feasible and scheduled for production in the next few years. At a time of zinc crisis, where MMG is also the only zinc junior miner listed on a major exchange in the U.S., MMG’s 100% owned Sierra Mojada project could become the premier mining takeover target. We expect multiple takeover bids at much higher levels from cash rich major mining companies looking to replace their depleting reserves. While we believe shareholders would best be served by MMG going to production alone, takeover bids would ensure MMG a more appropriate market valuation for their premier assets.

Archives

January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 May 2010

Great Investments Home Email GreatInvestments

Great Investment Articles Blog Great Trades BlogDisclaimer: Great Investments may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Investments contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Investments does not provide personalized investment advice.

Enter your email address in the box below to get emailed any new blog entries (within an hour or so of an update). Your email address won't be listed or sold.